How can a health insurance chatbot improve your customer service?

Le chatbot assurance prévoyance santé peut-il aider à désengorger votre service client ?

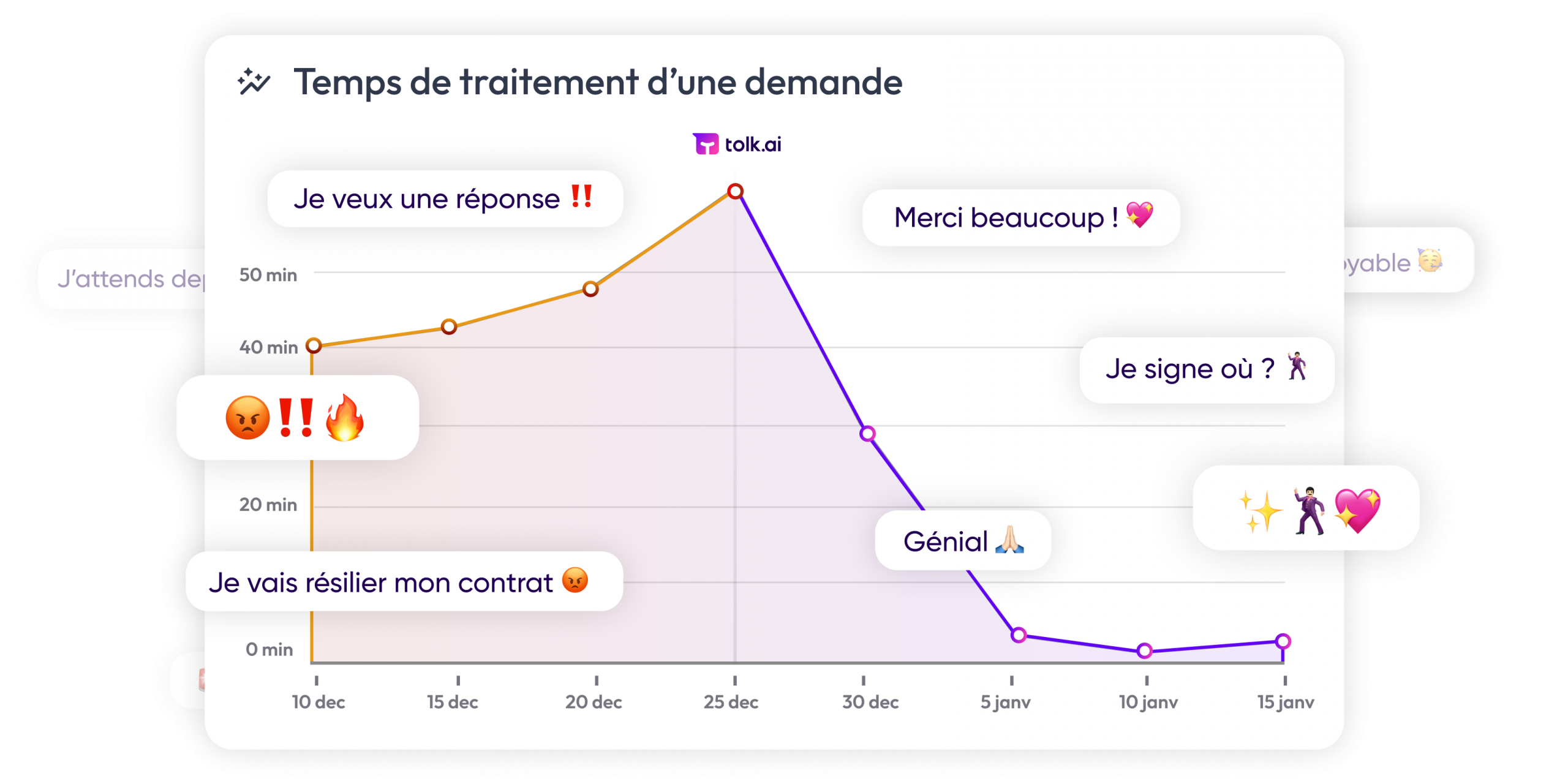

Les périodes de fin et début d’année sont souvent difficiles pour les services clients des organismes d’assurance et mutuelle. La demande augmente fortement. Les ressources deviennent rapidement limitées.

They therefore have no choice but to find an effective solution to meet their customers' needs.

Fortunately, chatbots can be a very useful solution for answering customer queries and relieving congestion in your service department.

In fact, since they can be programmed to :

- Quickly answer routine and complex questions without having to call in a member of staff or a qualified representative.

- Provide customers with 24/7 support, enabling us to respond to requests in record time (at tolk.ai, we note that 1/3 of conversations are conducted outside customer service opening hours).

Chatbots : la solution pour désengorger votre service client

Finally, chatbots developed on the tolk.ai platform offer a versatile configuration that can be easily adapted by the business, in full autonomy thanks to 100% no-code interfaces.

Une aubaine quand on sait à quel point certains chatbots peuvent être complexes à paramétrer et gérer ou à enrichir.

It's clear, then, that chatbots are a powerful tool that can facilitate the work of customer service by supporting them and relieving them of time-consuming, non-value-added tasks.

Ils permettent non seulement d’automatiser certaines tâches complexes, mais aussi d’améliorer l’expérience client en proposant un service personnalisé ainsi qu’une variété de fonctionnalités intuitives permettant de garantir la satisfaction du client.

What are the advantages of chatbots in the health insurance sector?

Chatbots can facilitate communication between you and your customers, while reducing the time and cost required for each interaction. They are designed to learn as customers interact with them, and update their functionality accordingly.

Managing routine tasks

When a chatbot is integrated into your customer service department, it can be configured to handle many common tasks. For example, a chatbot can be programmed to answer frequently asked customer questions and provide immediate information.

C’est le cas d’Entoria, courtier grossiste en Assurance de personne, qui a réussi à filtrer les demandes grâce au chatbot et réduire de 80% les appels entrants du service client

Learn more about Entoria's experience with tolk.ai's chatbot.

Managing complex or specific tasks

Chatbots can also be configured to perform specific tasks such as :

- Open and manage support tickets, identify customers,

- Management of invoices and payment schedules,

- Reminder of insurance contract expiry dates,

- Modifying, downloading or duplicating a third-party payment card.

But that's not all: a chatbot can support several different languages, making it easier to communicate with international customers.

Multitasking and intelligent

An insurance/mutual insurance chatbot is capable of handling multiple requests simultaneously, which means it can manage several conversations with different customers at the same time, without compromising the quality of the service provided.

This enables companies to provide faster, more reliable support to their customers during the peaks at the end and beginning of the year.

What's more, when properly configured and integrated into an existing system, they offer users a consistent experience with a variety of additional features such as :

- Machine translation

- Instant access to personalized content,

- Anticipate ancillary questions in response to a specific answer.

Although the personalized content in question is often available via the policyholder area, automation enables the policyholder to access this content easily and directly.

With these considerable advantages, it's clear that chatbots are an excellent choice for improving your customer service during seasonal peaks.

Connect your business APIs for even more personalized health insurance chatbots?

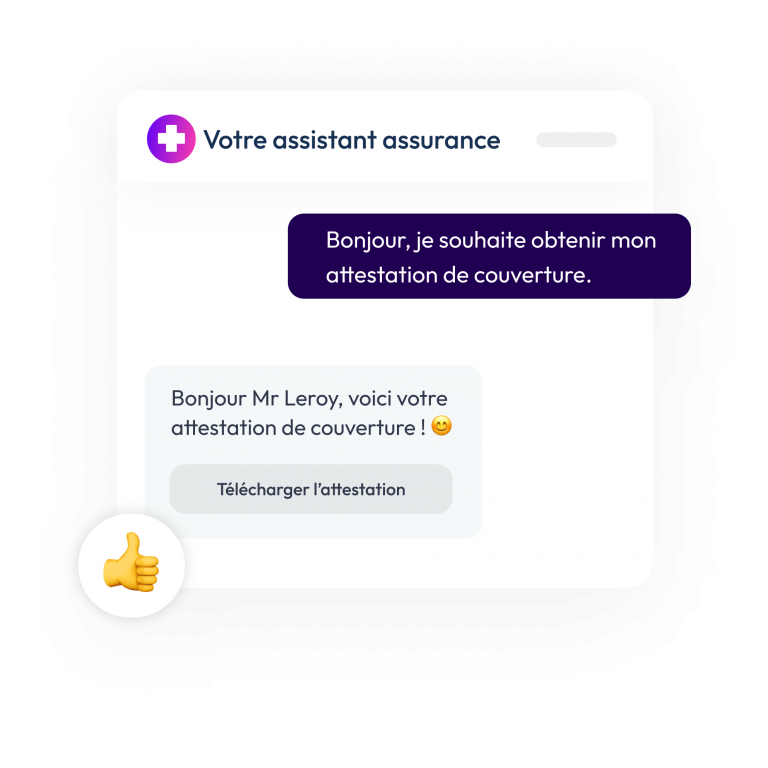

Tolk.ai met à votre disposition un API Manager. Cet outil vous permet de personnaliser et d’améliorer l’expérience de vos clients. Concrètement, l’API Manager agit comme une interface.

Il permet d’ajouter et de paramétrer la connexion entre un outil externe et votre assistant Tolk.ai. Ainsi, vous connectez facilement votre chatbot à vos systèmes métier.

De plus, le chatbot accède rapidement aux informations utiles pour les clients. Grâce à ces connexions, le chatbot interroge différents systèmes back-end. Il récupère alors les données nécessaires, sans intervention humaine. Ensuite, le client pose librement ses questions. Il agit comme lors d’un échange avec un agent du service client. Le chatbot traite des demandes simples ou complexes. Il fournit également des réponses personnalisées ou non.

Enfin, chaque réponse reste contextualisée. Elle intègre directement les informations gérées par vos applications métier.

Magic, isn't it? ✨😍

En conclusion, l’utilisation d’un chatbot en assurance santé prévoyance permet d’automatiser le service client. Il désengorge les équipes pendant les pics saisonniers. Le chatbot apprend avec l’usage. Vous pouvez ainsi adapter constamment ses réponses.

Keep in mind that good customer service means satisfied, loyal customers! 😉 So what are you waiting for to set up a chatbot with tolk.ai ?

Test the power of our chatbot now by booking a product tour today.